49+ how much equity is needed for a reverse mortgage

But they owe 180000. This is true for government-sponsored home equity conversion.

13 Reverse Mortgage Marketing Ideas Brandongaille Com

Put Your Home Equity To Work Pay For Big Expenses.

. Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Web 35 minutes agoCramer called being a banker to the private equity sector an attractive business model. Principal Limit MCA x PLF.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. 4 If your home is worth. Have zero delinquencies on any federal debt.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

The stocks still cheap The stock lost two-thirds of its value in 2022. Web In this example we will use a borrower aged 70 years old using a reverse mortgage for home purchase with a sales price of 400000. For a HECM loan this amount ranges from 479 to 75 of your.

39 93600 of their homes current 240000 appraised value. Web A round-up of the latest rate changes includes. Web Generally reverse mortgages require at least 50 or more in home equity.

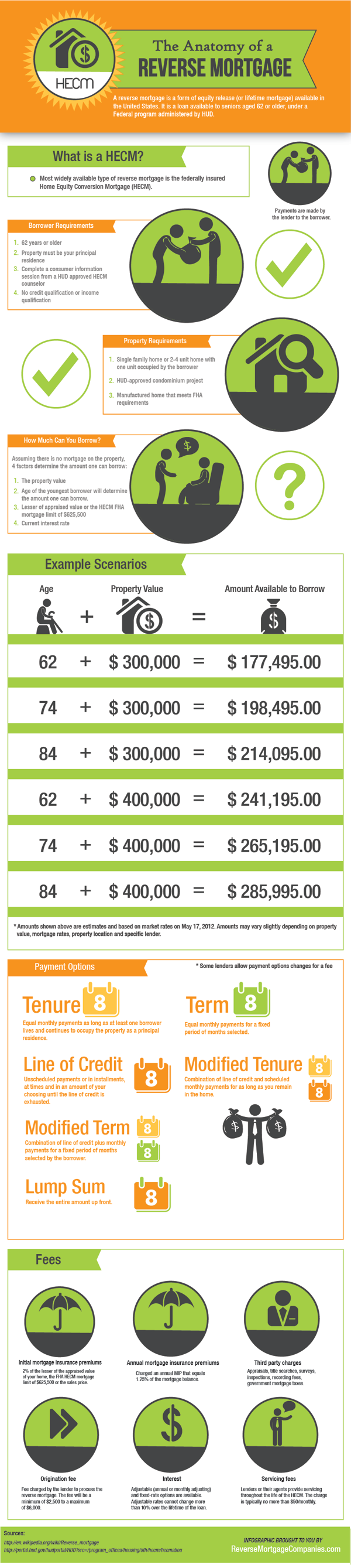

Web The amount you can borrow from your equity depends on your age and the interest rate for which you qualify. What Is A Reverse Mortgage. The downsides are you.

Web Closing costs include an up-front mortgage premium of 2 of the property value and can include other lender and third party closing costs such as an origination fee title. The older you are the more funds you can receive from a Home Equity Conversion. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Fixed rates have been cut by up to 024 percentage points for purchase remortgage and new build. So if your home is worth 500000 and you have 300000 in equity youd have 60.

The value of the reverse mortgage must be equal to or greater than the value of any loan secured against the property. Be at least 62 years old. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

Web reverse mortgages are limited to approx. Web General reverse mortgage requirements include the following. Web How much money you can access from a reverse mortgage will be calculated by a formula that takes into account the following key factors.

All borrowers on the homes title must be at least 62 years old. Own your home free and clear or have. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

650000 x 524. If youre an older homeowner with a lot of equity -- at least 50 -- in your home a reverse mortgage can be a smart pathway to accessing cash. Proceeds Year 1 Principal Limit x 60.

Why Not Borrow from Yourself. Think of a reverse. Web 22 hours agoThe FHA reverse mortgage recognizes property values up to 1089300 and not a penny more no matter what the true home value is.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Get A Free Information Kit.

For Homeowners Age 61. Web Reverse Mortgage Calculator Learn How Much Equity You Can Unlock from Your Home How much can you borrow with a reverse mortgage. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web The solution below shows how much money he can get in year one. Ad Compare the Best Reverse Mortgage Lenders. Web While you may qualify for a reverse mortgage with as little as 50 equity in your home the amount of your potential payout increases along with your equity.

Web Reverse mortgage age requirements. AGE You must be at least 62 years of. Web How much equity do I need for a reverse mortgage.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web The maximum amount of money you can get from a reverse mortgage is based on your homes appraised value up to a cap of 970800. For Homeowners Age 61.

First and foremost the homeowner must be 62 or older. Web Using a reverse mortgage homeowners can get the cash they need at rates starting at less than 35 per year.

:max_bytes(150000):strip_icc()/GettyImages-1133772954-79ce83b73f73459bbd0ee3fff2442ac5.jpg)

How Much Equity Do You Need For A Reverse Mortgage

How Much Equity Is Needed For A Reverse Mortgage Lendedu

Reverse Mortgage Details Unison Home Equity Sharing Blog

Gabrielle Levota Portfolio By Gabrielle Levota Issuu

Reverse Mortgage Is This The Solution If You Retire Cash Poor National Globalnews Ca

Reverse Mortgage How Much Equity Is My Home Required To Have Home Central Financial

Reverse Mortgage How Much Equity Is My Home Required To Have Home Central Financial

:max_bytes(150000):strip_icc()/GettyImages-1342608768-3f5ecb301b5e48968d2d514eb3406abc.jpg)

How Much Can You Get From A Reverse Mortgage

How Much Equity Do You Need For A Reverse Mortgage Easyknock

Reverse Mortgage Line Of Credit 5 Things You Need To Know Premier Reverse Mortgage

Most Reverse Mortgages Terminated Within 6 Years According To Hud

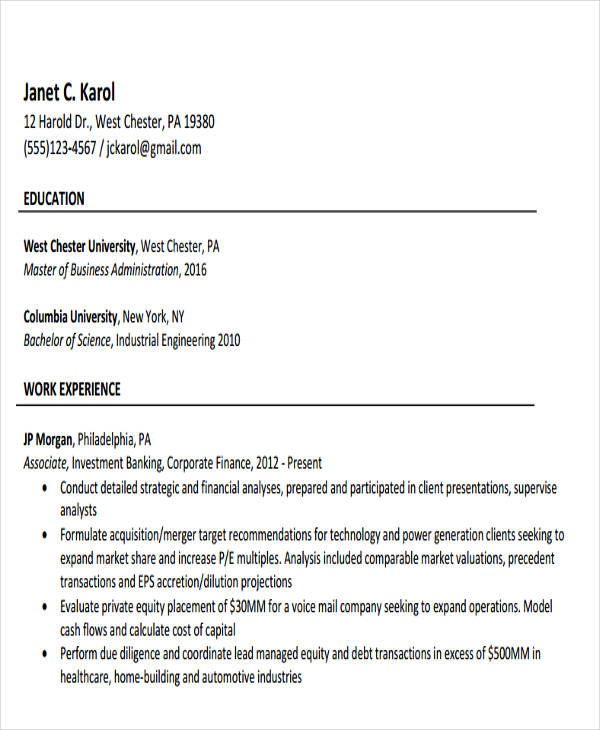

49 Banking Resume Templates In Pdf

Reverse Mortgage Details Unison Home Equity Sharing Blog

Reverse Mortgage Details Unison Home Equity Sharing Blog

How Much Money Can You Get From A Reverse Mortgage Cbs News

Reverse Mortgage Details Unison Home Equity Sharing Blog

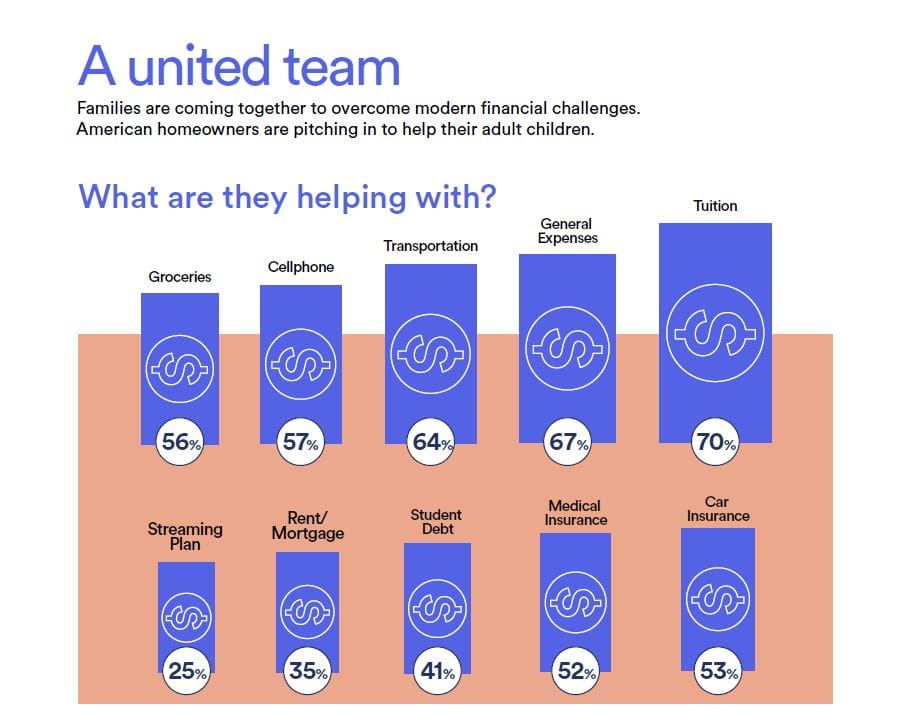

Ok Boomer Fessing Up That We Ve Had It Good